Following the issuance on 16th December 2019 of the Exposure Draft on Electronic Know-Your-Customer (e-KYC) which sets out the proposed requirements and guidance in implementing e-KYC solutions for onboarding of individuals to the financial sector, the Central Bank of Malaysia (“BNM”) on 27th December 2019 published the Exposure Draft on Licensing Framework for Digital Banks (“Draft Licensing Framework”) together with the following 2 policy documents:

(a) Application Procedures for New Licences under Financial Services Act 2013 and Islamic Financial Services Act 2013 (“Licensing Procedures”) which came into effect on 27th December 2019; and

(b) Application Procedures for Acquisition of Interest in Shares and to be a Financial Holding Company (“Acquisition Procedures”) which came into effect on 27th December 2019.

What is a Digital Bank?

Pursuant to the Draft Licensing Framework, a “licensed digital bank” is defined as a person licensed under:

(a) the Financial Services Act 2013 (“FSA”) to carry on banking business primarily or wholly through digital or electronic means; or

(b) the Islamic Financial Services Act 2013 (“IFSA”) to carry on Islamic banking business primarily or wholly through digital or electronic means.

Key Requirements for Digital Banking Licence

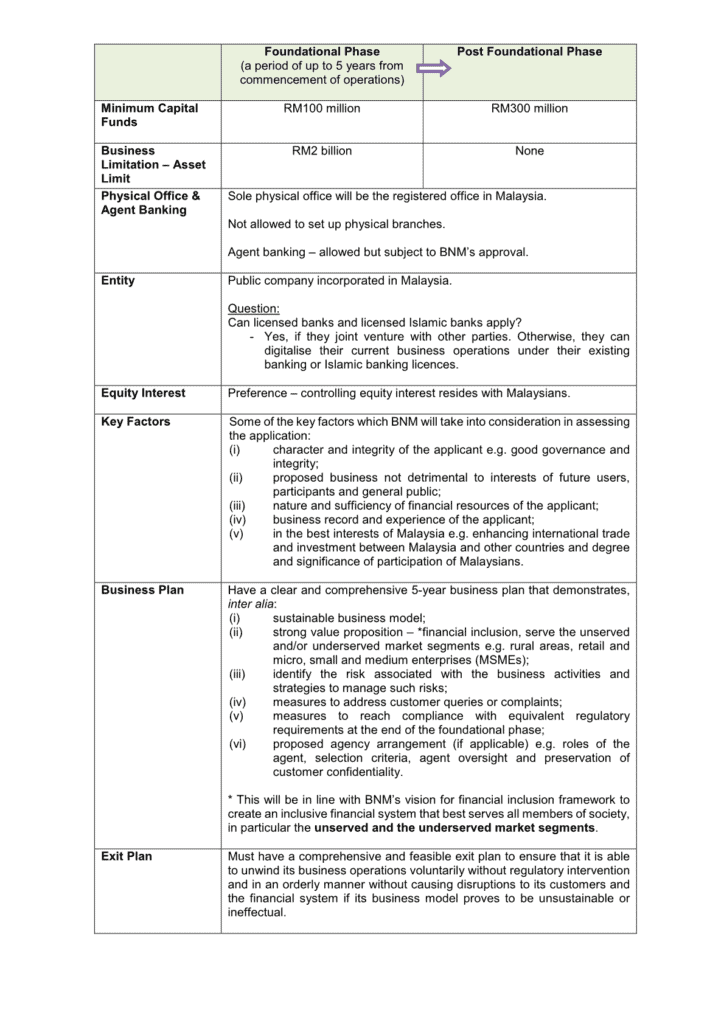

Based on the Draft Licensing Framework, the digital banks in Malaysia will go through a two-stage licensing process – during the foundational phase of 3 to 5 years, the digital banks will only be subject to simplified regulatory requirements but upon completion of the foundational phase, the equivalent regulatory requirements applicable to a licensed bank or licensed Islamic bank will apply.

Some of the key requirements and issues are set out in the table below.

Application Process

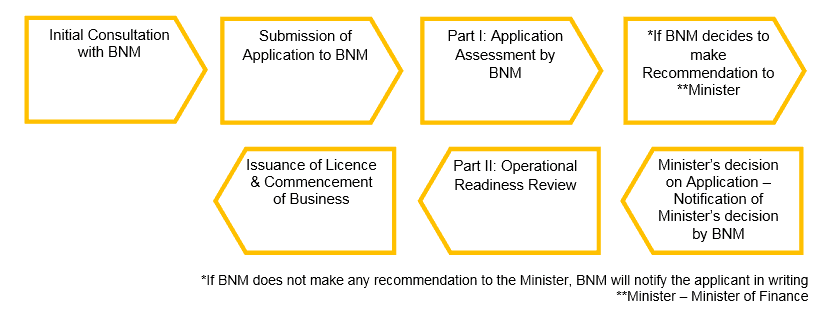

The application process is summarised below:

Note:

The Licensing Framework Draft is still open to feedback – all feedback must be in writing and should be submitted to BNM by 28th February 2020. BNM aims to finalise the Policy Document by the first half of 2020. Upon issuance of the Policy Document, applications for digital banking licences will be open. According to the press release issued by BNM on 27th December 2019, BNM will only grant up to 5 digital banking licences.

Contributed by:

Chong Mei Mei (Partner)

(T): +603-2632 9987

(E): chongmeimei@rdl.com.my

Lim Soo Ann (Associate)

(T): +603-2632 9940

(E): limsooann@rdl.com.my